We’re often faced with the open-ended question from clients about how to strategically plan for retirement, and often, the answers are not as simple as “yes” or “no” to a client-posed question. Usually, the best retirement strategies are a culmination of careful tax planning over many years, but sometimes, changing circumstances warrant a re-evaluation of the approach. Individual Retirement Accounts (IRAs) are one of the typical areas that clients look into when it comes to retirement planning. We believe that it’s important that clients understand the basic differences between traditional IRAs and Roth IRAs.

Similarities

Similarities

- Opening the account can be done through your financial institution or stock broker.

- Contribution limits: the contribution limit is $5,500 for each individual for 2016. An additional $1,000 is allowed for taxpayers age 50 and up (these are commonly called “catch-up” contributions)

- Contribution deadline: before your tax return filing deadline (April 15th is typical unless instructed otherwise). So, for example, if you wish to make an IRA contribution for the tax year 2016, you have until April 18, 2017 to contribute funds to the IRA for tax year 2016 – just ensure you correctly indicate on the funds deposit form the correct tax year you are contributing to.

- Over time, earnings grow in your Roth and traditional IRAs – as these earnings are growing, there is no tax on the growth so long as the funds remain untouched and are simply allowed to sit there.

- If you need access to these funds, you may withdraw them at any time, however, please note that there may be income tax and penalties on the withdrawal.

- In order to be eligible to contribute to either type of IRA, you must have “qualifying income”, which, generally speaking, is income that is:

- Earned as an employee

- Earned as a self-employed individual

- Received as alimony

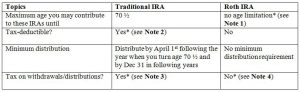

Differences

Note 1: Although a taxpayer may contribute to a Roth at any age, his/her modified adjusted gross income has to be below the certain thresholds, which depend on filing status. For 2016, the allowable contribution to a Roth IRA will be phased-out if modified adjusted gross income is between $117,000 and $132,000 for single filers, $184,000 and $194,000 for joint filers, and $0 to $10,000 for married filing separate filers.

Note 2: Generally, a contribution to a traditional IRA is tax-deductible. However, if taxpayers participated in their employer’s qualified retirement plan(s), any allowable Traditional IRA deduction may be limited or completely phased out depending on filing status:

- For married filing jointly: the allowable deduction amount for a Traditional IRA contribution will be reduced when modified AGI is between $98,000 and $118,000 for 2016.

- For single individuals or head of household: the IRA deduction starts to phase out when modified AGI is between $61,000 and $71,000 for 2016.

- For married filing separately: the IRA deduction begins to phase out when the individual’s modified AGI is over $0, and the deduction is completely phased out when modified AGI is $10,000 or more.

Additionally, it is worth mentioning that individuals who do not work but have a working spouse who does contribute to an employer retirement plan have additional limitations on IRA contribution phase outs. We’re more than happy to answer questions associated with this.

Note 3: Under the general rule, traditional IRA withdrawals/distributions are taxable. Also, early withdrawals (under age 59½) may incur an additional 10% early withdrawal penalty (this penalty is in addition to income tax), unless the withdrawal qualifies under an exception for the penalty.

Some general exceptions to the 10% early withdrawal penalty (not an exhaustive list, see more on the IRS website) include:

- the death of the account owner

- total and permanent disability of the account owner

- distributions made to pay for qualified higher education expenses

- distributions made for qualified 1st-time homebuyers

- distributions made for qualified medical expenses.

Note 4: Generally, Roth withdrawals/distributions are not taxable if the distribution occurs after a 5-year period (starting the first taxable year when the contribution is made) and qualifies based on one of the following:

- the payment made at the age 59 ½ or older

- the account owner becomes disabled

- the distribution is made to a beneficiary or estate upon the account owner’s death

- the distribution is made for a first-time home buyer

Both IRAs have their advantages and disadvantages. In general, Traditional IRAs will be more beneficial if you expect your future tax rate will be lower than the tax rate you have now. Conversely, choose Roth IRA if you anticipate that you will have more income when approaching your retirement.

As you can see, retirement planning is complex and subject to many different considerations, even for the most basic of retirement planning questions! Please consult us for the best advice as it pertains to your specific situation. We’re more than happy to help!

Sources:

https://www.irs.gov/retirement-plans/traditional-and-roth-iras

https://www.irs.gov/publications/p590b/ch02.html#en_US_2015_publink1000231081