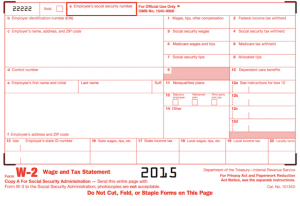

It’s that time of the year AGAIN! The end of the year is only a few months away and to reduce your stress level during this busy time of year, below are several items to start checking off of your list:

If you are an S-Corporation Shareholder, then REMEMBER to process your payroll add-backs:

When does my 3rd party payroll provider need to have this information by so that I am not charged extra for a special payroll? Answer: Each payroll provider has different “cut-off” dates for year end information. Generally, the cut-off is sometime during the first part of December. Contact your payroll rep and find out their date so you can be prepared.

Do I have to report my health insurance that the company paid on my W-2? Answer: If you are a 2% or greater shareholder then yes you do. The total amount to be paid by the company on your behalf needs to be included with your other payroll add-backs given to your payroll provider.

I drive one of the company vehicles back and forth to work and on the weekend. Do I need to report this on my W-2? Answer: Yes, you should provide with the vehicle information and the miles driven and we can assist you with this calculation. Or you can contact us and we can provide you with a spreadsheet so that you can do the calculation yourself.

Below are some links to the IRS website where compensation of a Shareholder are discussed to provide you with additional knowledge.

http://1.usa.gov/1e9gXSn

http://1.usa.gov/1WnOjiI